Areas of expertise

ACMI (Aircraft, Crew,Maintenance, and Insurance)

Our ACMI airlines comprise a combined global fleet of 221 aircraft, spanning 11 established AOCs, with a further 4 in development. Delivering customised wet lease and air charter solutions, we enable scheduled airlines and tour operators to meet their strategic and business-critical objectives worldwide.

Jaguar Aviation ― the world’s largest ACMI provider

The passenger ACMI market is led by Jaguar Aviation with ~8% of the total block hour market share

Our airlines operate a total of 221 aircraft, which contributes to approximately 38,000 seats to the global passenger aviation market

Our airline companies hold 11 Air Operator Certificates (AOCs), with a further 4 in development

Our airline companies hold 11 Air Operator Certificates (AOCs), with a further 4 in development

Our airlines carry 35m passengers every year

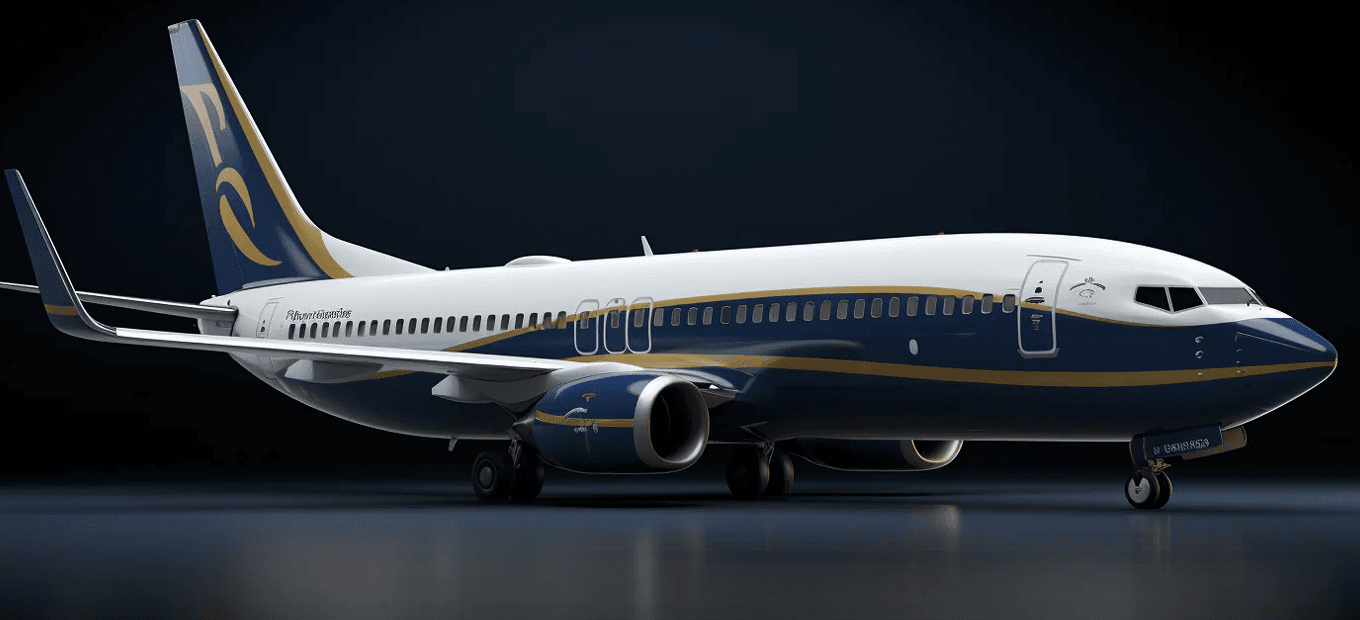

Our airlines' aircraft can be fully branded with an operator'slivery for the duration of the ACMI contract

With a diversified customer portfolio, our top 5 customers share just 48% of our fleet’s total block hours

Our ACMI services are complimented by our supporting network infrastructure, including MRO, crew training, and ground handling

Verified ACMI inventories

An ACMI carrier in any country or continent must be well-established and operate all year round, primarily serving the local market, so that it can effectively adjust capacity during peak and non-peak seasons. Our airlines, distributed across 6 continents, fully fulfill these criteria. Discover our carriers below.

+

coconut

+

xoxo airways

+

airline1

+

acmi wa

+

+

new airlines

+

Explore our ACMI airlines

An ACMI carrier in any country or continent must be well-established and operate all year round, primarily serving the local market, so that it can effectively adjust capacity during peak and non-peak seasons. Our airlines, distributed across 6 continents, fully fulfill these criteria. Discover our carriers below.

Empowering Airlines through ACMI

ACMI is a strategic profit-accelerating aircraft leasing practice that allows scheduled airlines to manage their fleets more efficiently, adjust to market fluctuations, and optimize operational costs. By integrating ACMI as part of an airline’s long-term strategy, both aircraft capacity and income can be maximized.

Contract type

ACMI

Service scope provision

Aircraft

Crew

MRO

Insurance

AOC part of services

Typical contract lenght

1m-5yrs

Payment terms

Per BH rate, minimum hour guarantee

Capacity demand

The ACMI leasing market has experienced significant growth over the past five years, driven by several factors that coincide with the commercial aviation’s recovery from the global COVID-19 pandemic.

2019 levels of passenger traffic have returned, driven by supply.

Major EU legacy carriers quote 6% of seasonal capacity is now provided by 3rd parties.

26,000 commercial aircraft globally, 1,560 as ACMI ops.

Restrictions led by aviation authorities and unions allow cross-border investment.

Servicing peak periods

Supply chain disruptions and production backlogs in aircraft manufacturing, combined with the global shortage of qualified pilots, has compounded operational challenges for airlines. This has prompted further ACMI partnerships to allow airlines to meet service demand, without the need to wait for new aircraft or pilots. Commercial airlines’ main business case for ACMI utilization is to provide additional capacity during peak seasons. This is particularly prominent in Europe where there is a 31% difference in passenger numbers between the low and high season, resulting in an additional 153 million passengers in the summer period.